Applied Macroeconomics:

The Architecture Of The Global Monetary System

PRICE

$ 2999 33% OFF

$ 1999

Most Popular

Complete 10-Module Video Curriculum

The "Sovereign Archive" (Assessments & Resources)

Email support to get your questions clarified

Access valid for 365 days from the date of purchase, with unlimited views.

Total Course Video Content: 2 Hrs+

(I’ve intentionally stripped out the fluff. These more than two hours of video content are designed to deliver maximum clarity and value.)

The Operating System Of The Global Economy.

Stop playing the game. Start engineering it. A professional-grade theoretical briefing on Central Banking, Sovereign Debt, and the Geopolitics of Money.

You Are Trading Blind.

Most market participants are fixated on the wrong things. They obsess over stock tickers, technical patterns, and the noise of the daily news cycle. They are passengers on a ship they do not understand.

The real game is not played on the stock market. It is played in the Bond Market, the Repo Market, and the Central Bank balance sheets.

If you do not understand how liquidity is created, how collateral is valued, and how geopolitics dictates trade, you are not an investor. You are liquidity for those who do.

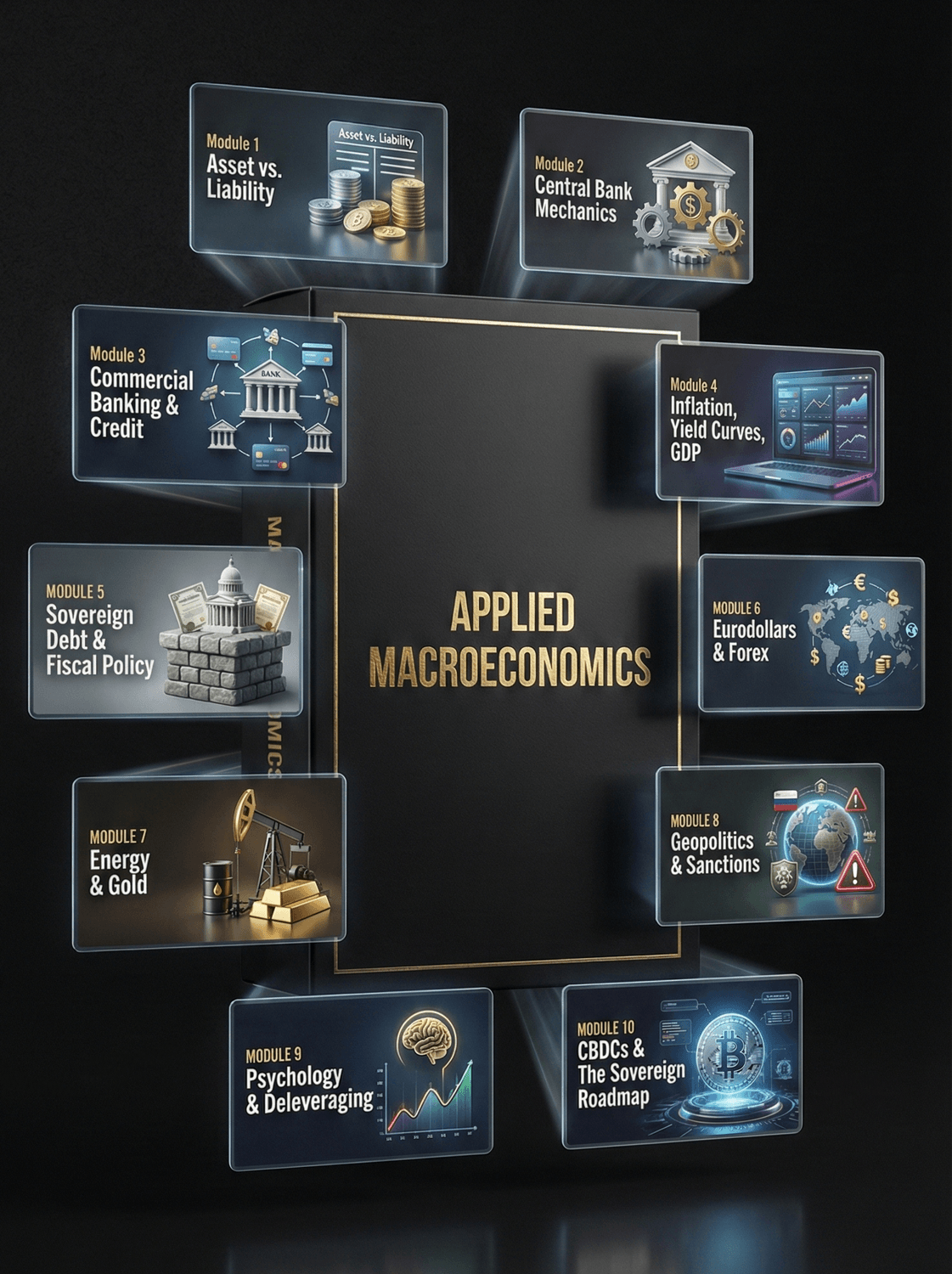

The Curriculum

Module 1: The Foundations of Money (Asset vs. Liability)

Module 2: The Engine Room (Central Bank Mechanics)

Module 3: The Transmission System (Commercial Banking & Credit)

Module 4: The Dashboard (Inflation, Yield Curves, GDP)

Module 5: The Bedrock (Sovereign Debt & Fiscal Policy)

Module 6: The Global Macro (Eurodollars & Forex)

Module 7: The Real Economy (Energy & Gold)

Module 8: The War Room (Geopolitics & Sanctions)

Module 9: The Cycle (Psychology & Deleveraging)

Module 10: The Future (CBDCs & The Sovereign Roadmap)

The Instructor

Mugada Siva Ganesh

Researcher, Entrepreneur, Author.

Mugada Siva Ganesh is an independent financial researcher, entrepreneur, and author driven by a singular mission: to strip away the artificial complexity of the financial world and reveal the logical machinery underneath. With years of experience navigating the volatility of the markets and the realities of building businesses, he has focused on synthesizing complex economic data into clear, actionable decision-making frameworks.

His work is defined by the conviction that valuation is not a black box reserved for institutional elites, but a learnable skill based on discipline and evidence.

He is dedicated to providing the tools for anyone focused on building something meaningful—whether it is financial independence or a stronger version of themselves—to move from guessing to knowing, and to master the art of the long game.

Terms and Conditions:

Access to all lectures is valid for 365 days from the date of purchase, with unlimited views.

To continue watching after your access expires, you’ll need to repurchase the course.

Course fees are non-refundable. Due to the immediate delivery of digital intellectual property and the proprietary nature of the information, all sales are final. Please review the curriculum carefully to ensure this protocol aligns with your educational goals before enrolling.

Frequently Asked Questions:

No. The curriculum follows a "First Principles" approach. We begin in Module 1 by defining what money is. We build the complexity layer by layer. While the destination is institutional-level knowledge, the journey assumes zero prior expertise—only intellectual curiosity.

This is not a standard "course" containing generic information. It is a professional-grade briefing and a synthesized protocol. The price reflects the years of research required to deconstruct these systems and the potential value of avoiding a single catastrophic mistake in a shifting macroeconomic environment. It is priced as a capital investment, not an expense.

It starts from first principles, but it ramps up quickly to institutional-level concepts. It is designed for the intellectually curious.

This is Module 11. It contains all assessments, debriefs, and resource links from the entire program. It is designed as a overall reference library, allowing you to refresh your knowledge on specific topics (like "Sanctions" or "CBDCs") without re-watching hours of footage.

Absolutely not. This is a theoretical and historical education on the mechanics of the global system. You are responsible for your own decisions.

No. This is an educational program on Market Architecture. We teach you how to read the dashboard (Inflation, Yield Curves, Liquidity) so you can build your own conviction. We do not provide financial advice; we provide financial intelligence.

The internet provides fragments; this course provides the system. For example, online you might learn what the Yield Curve is. In this protocol, you learn how the Yield Curve interacts with the Repo Market to trigger a Sovereign Debt Crisis. The value lies in the sequence, the synthesis, and the comprehensive structure.

Disclaimer:

We are not registered financial, investment, tax, or legal advisors. The information provided is for educational purposes only. Do not take any buy, sell, or any other action based on this content. Before making ANY decision-financial, legal, business, career, or otherwise-it is your absolute responsibility to consult with your own team of qualified, licensed professionals who can understand your unique circumstances.

Disclosure:

To support the channel, some links provided may be affiliate links, meaning we may earn a commission at no extra cost to you. We only recommend products and services we believe are relevant and valuable, but do not endorse any specific product and encourage you to conduct your own research.

Contact Us

support_capital@mugadasivaganesh.com

Copyright © 2026 Mugada Siva Ganesh Capital. All Rights Reserved.

Privacy policy | Legal | Terms and conditions